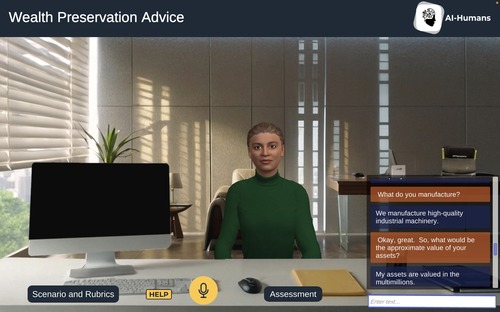

Harper Ellington, a high-net-worth individual from Milwaukee, meets with a bank executive to discuss wealth preservation amid economic uncertainty. Concerned about investment fluctuations, she seeks expert advice to protect her assets and ensure growth.

Logan Ashford, a 31-year-old software developer in Boston, is at the bank for a routine transaction. The teller suggests additional financial products, like savings plans or investment options. Logan is interested but has concerns about risks and fees.