The past two decades have seen a significant growth in the banking industry. As per reports by McKinsey, the global banking industry assets have grown from $49 trillion to over $155 trillion between the years 2000 to 2020. In this same period, the revenue of the top 1000 banks across the globe has risen from $2 trillion to $4.8 trillion. These can be attributed to factors like regulatory changes, advancements in technology, the ease in banking operations, and increasing customer expectations. The advent of digital banking has a large role to play in this growth. With the easy access of the internet and fingertip banking, an estimated 3 million people were known to be using mobile banking services in the year 2020. It is worth noticing that around the 2000s mobile banking was just taking off. With easy banking services, heavy competition in the field and an increasing customer base, the need for banking training programs for excellent customer service becomes imperative.

Significance of customer service in the banking sector

A recent Accenture report titled Global Banking Consumer Study talks about how consumer expectations are changing when it comes to the roles banks play. Banks are no more just houses to deposit and withdraw money. Consumers look upon banks to act as advisors as well when it comes to seeking help with financial matters. No doubt, the integration of AI and chatbots helps resolve basic issues, but when it comes to requesting specific information, advise on where to invest, how to invest, the type of plans available, and similar matters, a recorded message is the last thing a customer would like to hear. Human interaction becomes important in such scenarios, and preferably, a face-to-face meeting.

Finances affect all aspects of our lives which causes everyone to be extra cautious and careful when it comes to money matters. Knowledgeable, confident and empathetic bank representatives come across as assuring and trustworthy. A bank owes its existence to its customers; the more customers it has the better its growth. This in turn is dependent on fine customer services making it important for all banks to invest in efficient and engaging training programs; not just initially but continually.

What comprises effective customer service in banking?

Customer services in banking goes beyond resolving complaints and queries. It includes building and maintaining a relationship with the customer. That is probably why the designation is named Relationship Manager. The quality of customer service is a key feature motivating customers choices in banks. A range of skills can be listed that can help drive loyalty and retention.

Communication skills: This lies at the heart of every relationship and holds true to the banking sector as well. When customers trust the bank with their hard-earned money, they need clear and coherent information. A good relationship manager will be able to explain and provide answers with clarity, leaving no room for doubt.

Empathy: Getting into the shoes of the customer, understanding their needs, providing suggestions and advice based on their requirements makes customers feel significant and valued. When a customer approaches the bank seeking advice on retirement planning, they expect the representative to understand their needs. When they are assured that their needs can be identified, it makes them feel at ease.

Confidence: No one would trust a person who acts shifty, is not sure of what they are saying and shows signs of doubt, and when it involves their investments, it is certainly out of question. A customer service representative of a bank has to be confident and sure of what they are proposing.

Product knowledge: As a representative of a bank, the last thing a customer would like to see would be lack of product knowledge. All banks have varying products and services for customers making them unique in their places. When a customer approaches a bank, the representative attending them must be able to present them with a detailed knowledge of the product options available.

Transparency: Money matters call for transparency. Customers need complete information about products, services and fees. Offering proper and clear information regarding these aspects prevents misunderstanding and helps build trust and loyalty.

Problem solving: Customers may run into various kinds of problems, but a quick resolution is always expected and appreciated. This is crucial to build and maintain customer satisfaction.

Opting for AI-powered customer service training

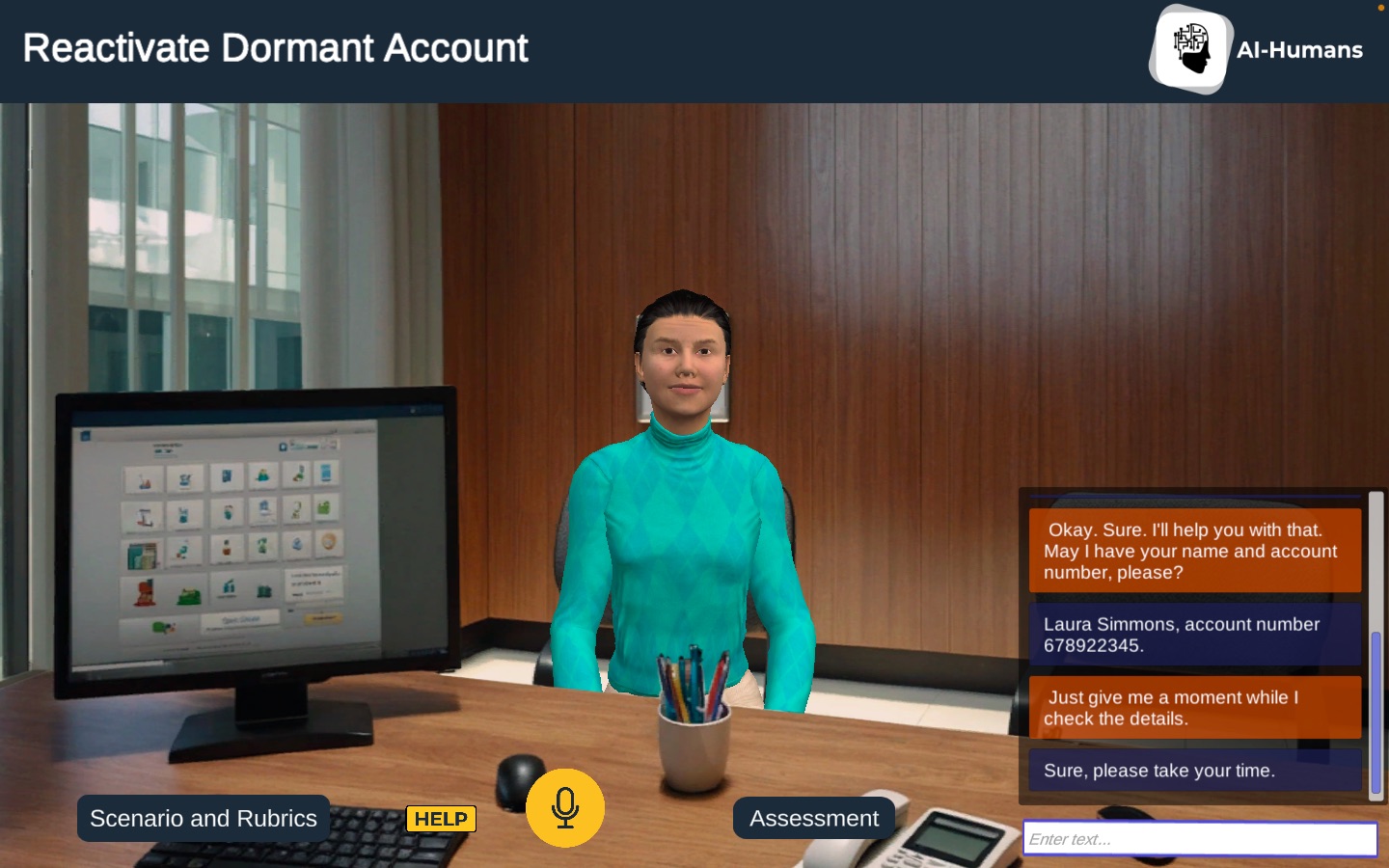

AI is making life better in many avenues. When it comes to training and development it is helping build better training solutions and assisting learners with enhanced learning options. A platform like AI-Humans is a step in in that direction.

Some of the key features that set this platform apart from other training options include benefits for both trainers and learners.

Quick creation of training material: It is not an exaggeration when we say that training content on the AI-Humans platform can be created within minutes. It takes no more than 10 minutes to create a training scenario on the platform furnished completely with a virtual AI-powered character and a realistic virtual environment.

No technical knowledge required: Instructional designers and L&D professionals can create these engaging and immersive AI-powered trainings. It is a tool that anyone with basic computer knowledge can use.

Immersive and engaging scenarios: AI-powered characters are placed in realistic environments. Conversations are organic and free flowing. Learners can talk and interact as they would with any other human.

Perspective building: Being AI-powered, the characters are trained on a large language model and have a massive database of knowledge. Interacting with them means treading into deep waters, exploring multiple aspects of an issue and a variety of ways to look at it. This helps build perspective.

Customized training: Select the topic of training, the character, the environment and assessment rubrics. Every aspect of the training is customizable. What’s more, every scenario can have different rubrics, based on the skills being practiced.

Real-time feedback: The end-of-session feedback provides an instant review of the performance. Learners know how they fared and where they need improvement. Trainers get to know how the learners performed and what aspects of the training would need modification to make it more effective.

Conversation logs: A conversation log is generated for the conversation a user has with a character. These logs are available to trainers to view the performance of the learners.

Easy accessibility: Training modules are accessed on computer browsers and can also be uploaded to an existing company LMS.

The banking industry has seen huge changes, the most significant one being digitization. This has resulted in increased use of banking services and a shift in customer expectations from banks. The roles of banks are changing and to cater to these altering customer demands it requires skilled customer services. Banks must invest in effective banking training programs to help meet these increasing demands to stay alive and successful in this constantly evolving environment.

AI-Humans from ELDC is a SaaS-based platform that enables trainers to develop AI-powered durable skills training solutions within minutes. While all technical aspects of creating these AI-powered scenarios have been taken care of by the team, trainers can devote all their attention towards giving shape to highly effective and relevant training and provide learners with engaging and immersive training opportunities. Practicing durable skills is the best way to learn and this is precisely what AI-Humans is providing.