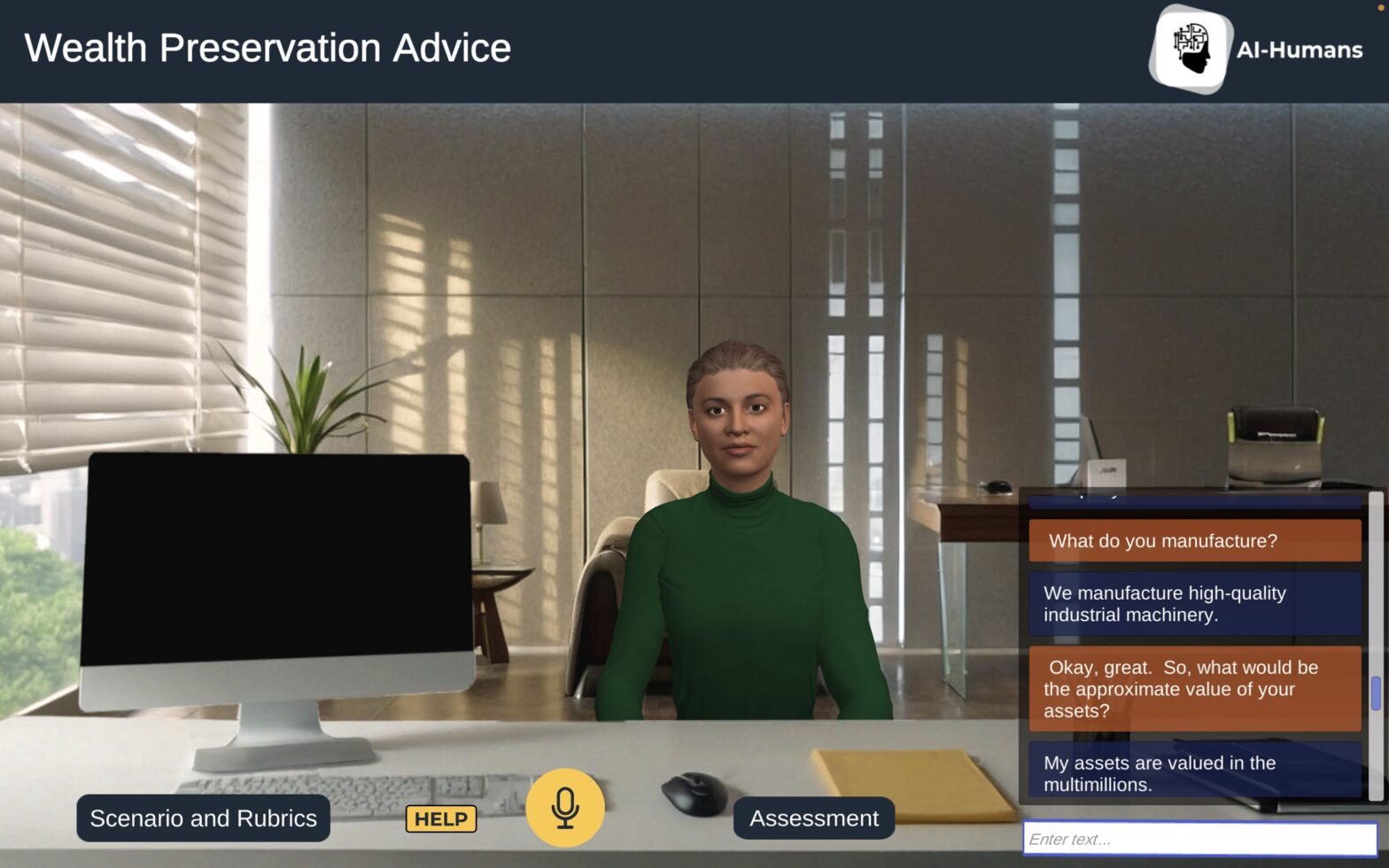

Harper Ellington, a 40-year-old high-net-worth individual from Milwaukee, Wisconsin, meets with a bank executive to discuss strategies for preserving her wealth amidst global economic uncertainty. Concerned about fluctuations in her investments, she seeks expert guidance to safeguard her assets and ensure sustainable growth.

As the bank executive, your role is to advise Harper on diversification strategies, alternative investments, and potential tax implications. Your goal is to address her concerns, offer reassurance, and guide her with a clear, strategic financial plan during these volatile times.

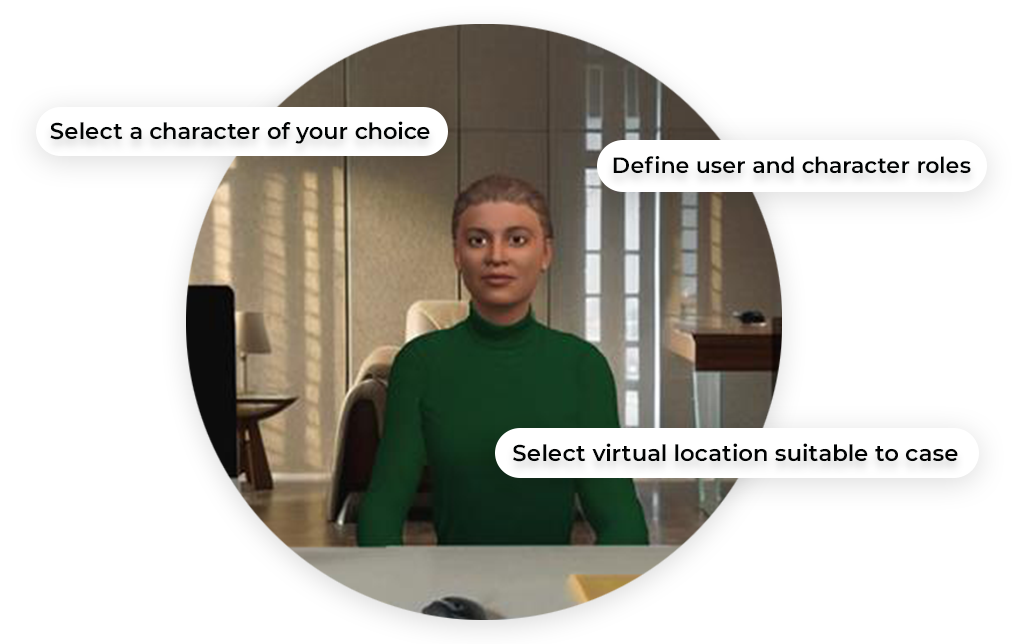

With the AI-Humans platform, create fully customizable AI-powered immersive scenarios for soft skills training. You have the power to: