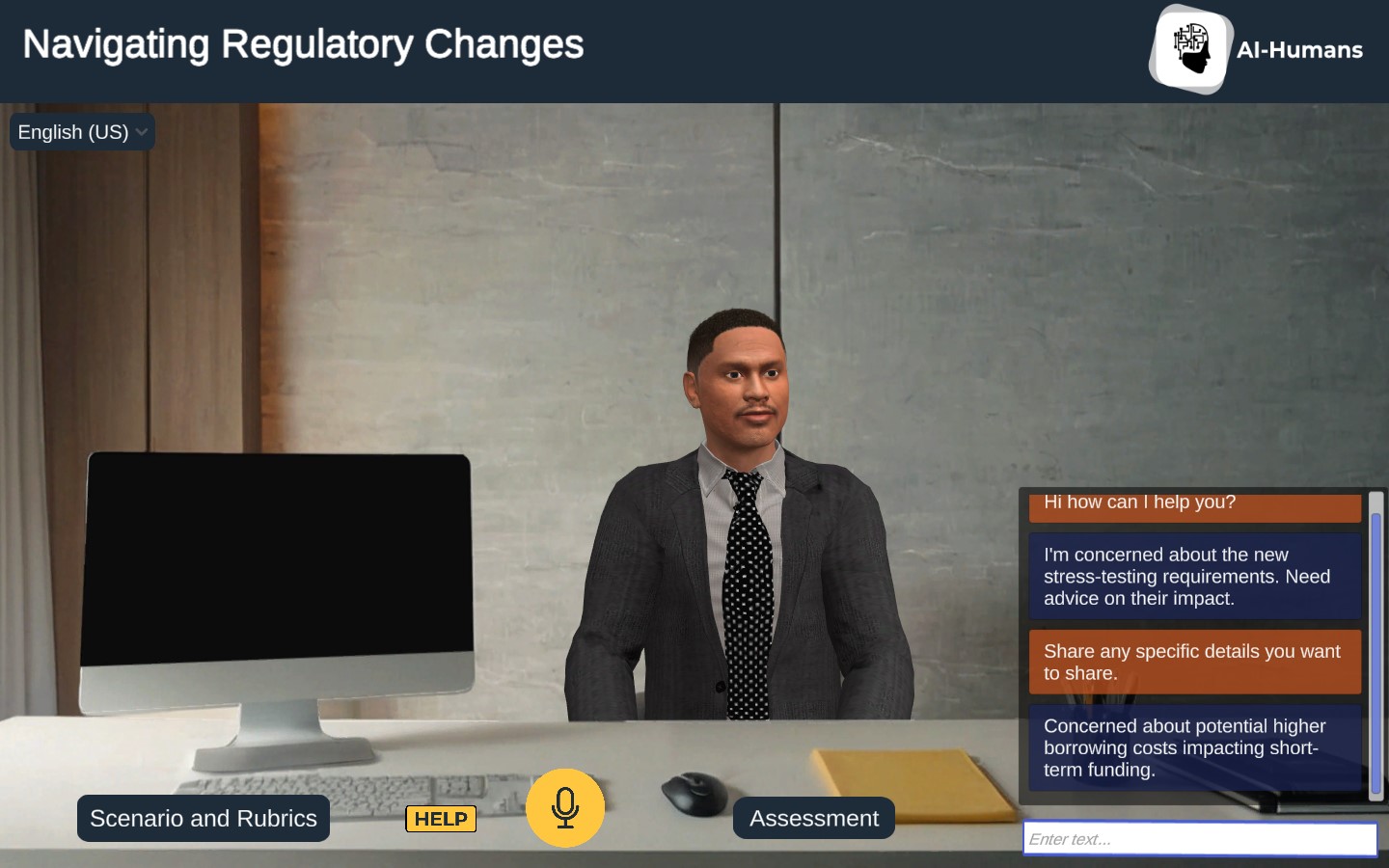

Griffin Holloway, a corporate client, is concerned about how the Federal Reserve’s updated stress-testing requirements might impact borrowing costs and access to credit. His business relies on short-term funding, and these regulatory changes could affect loan evaluations and credit risk ratings.

As the compliance officer, your role is to explain the implications of these new requirements, address Griffin’s concerns about his credit terms, and provide recommendations for mitigating risks, such as enhancing financial disclosures or exploring diverse funding options.

With the AI-Humans platform, create fully customizable AI-powered immersive scenarios for soft skills training. You have the power to: